Natural Capital

Valuation Framework

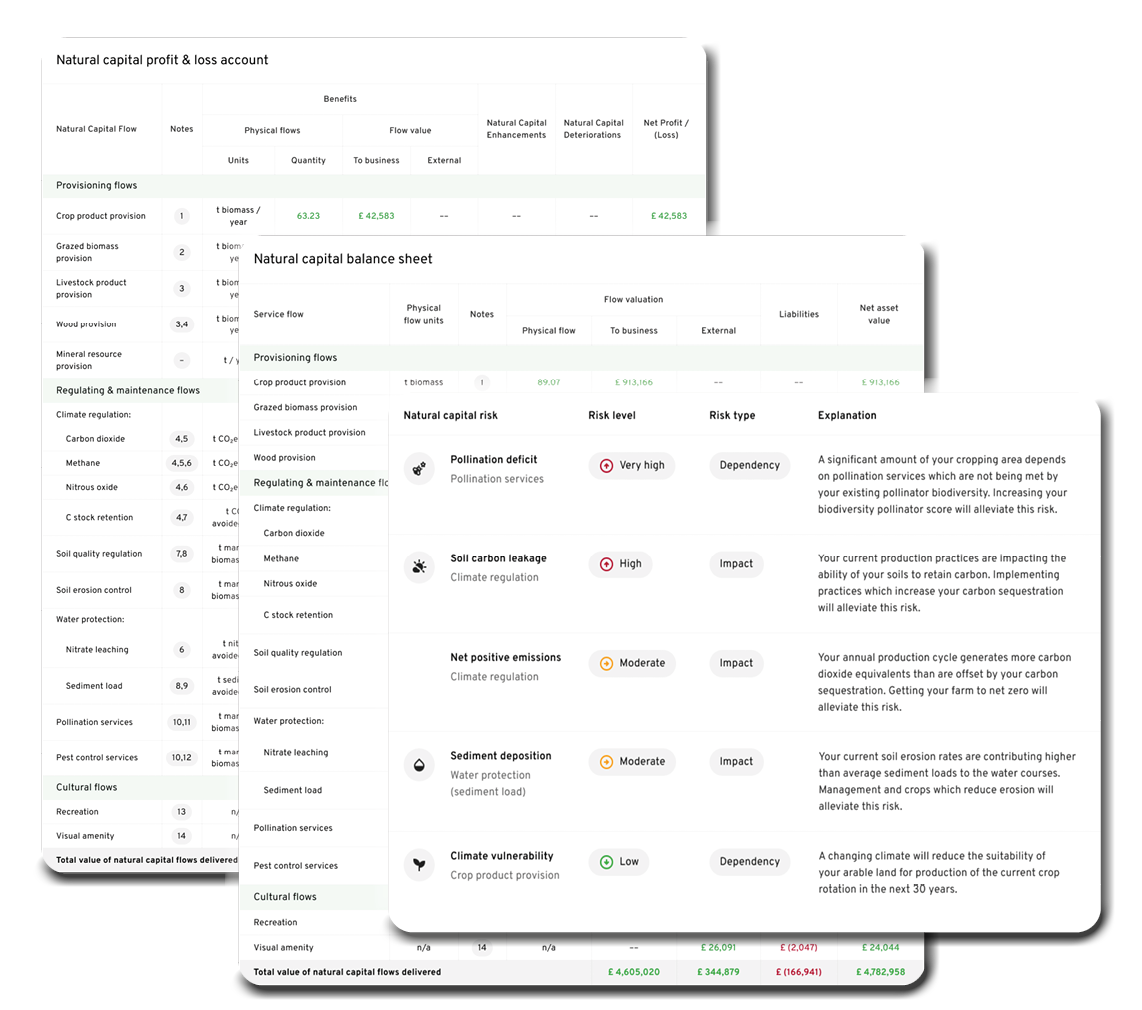

Trinity Natural Capital Pro Council has developed a comprehensive valuation framework for the natural capital assets present on a farm or estate.

This framework, including a natural capital risk register, is encoded within the Natural Capital Valuation module of Sandy, Trinity Natural Capital Group’s new generation natural capital navigator.

Following the Council’s guiding principles of implementing protocols, methodologies, tools and services that exemplify best practice and the highest professional standards, the following module is fully aligned with the United Nations System of Environmental-Economic Accounting (seea.un.org) and BSI Natural Capital Accounting for Organizations (BS 8632:2021).

Who can access the natural capital valuation framework?

It is available to farms collating natural capital insights on carbon, biodiversity, water protection, soil erosion and woody biomass.

To ensure credibility and reliability, the data and analytics are compliant with the latest standards governing carbon and natural capital valuation.

This means using IPCC 2019 methodologies or newer, tools and services which are also ISO14064-2 and ISO14067 accredited and compliant, as well as fully compliant with both GHG Protocol and SBTi FLAG.

What will the natural capital valuation framework help with?

Click the on-farm scenarios below to learn about the additional value added by the Natural Capital Valuation framework.

-

Combining value from a wide range of natural capital flows, fully reflecting the holistic impact of this management. These flows include value of sequestered carbon, value of improved pollinator and biological pest control support, value of SOM to yield improvements, and value of improved sediment and nitrate retention.

-

Indicating the value added by existing practices, as well as supporting the planning of those interventions which might add the most value to existing regulation flows. The farmer can use the natural capital valuation module to communicate this value effectively, and the program stakeholders can use the valuation to efficiently design incentives and frameworks for the program.

-

Indicating how maximum natural capital value might be generated by efficiently mixing different land uses and management practices for generation of provisioning flows (like crop or wood biomass provision), regulation and maintenance flows (like climate regulation) and cultural flows (like recreation and visual amenity).

-

Demonstrating the value of improved rotations in the form of soil quality enhancements, biodiversity-driven flows, and water protection. The risk register schedule can also indicate the risk exposure of certain crops to existing natural capital dependencies e.g. climate change.

-

Providing analysis and scenario planning capabilities to indicate how this land may be optimally deployed. Natural capital valuation can bring together all of the environmental impacts of management choices and help the manager optimise for maximum value across all flows, or a subset.

-

Providing the farmer with scenario-planning tools to design optimal natural capital management plans, and the ability to clearly communicate the value-add of these actions; permitting the farmer to share standards-compliant, harmonised natural capital accounting projections with a range of stakeholders across the farm's value chain.

-

Valuing the pollination services provided by the wildflower areas, as well as the value of reduced erosion in crop provisioning potential and the value of climate regulation provided by carbon sequestration in hedges.

-

Demonstrating to the user, via the profit and loss and balance sheet schedules, how much value is being realised directly by the business as well as how much is being provided to external parties (this could be a neighbour, or the entire world, depending on the nature of the flow). In reviewing this, the business manager can develop strategies to identify areas of maximum value provision that can be brought in-hand.

-

Indicating the value of this practice in the form of enhanced grazed biomass and livestock provisioning services, and in the climate regulation value of carbon sequestered in the soil.

-

Helping the farmer to demonstrate to lenders, buyers and supply chain stakeholders the value of the farm's natural capital assets, the benefits created by these assets, and the value added by the farm's management activities to these assets over the business year.

-

Indicating the enhanced potential wood provisioning value of the plantation, the climate regulation value of sequestered carbon, and the improved biodiversity-driven flows in the form of pollination servies, natural pest control, recreation potential, and visual amenity.

-

Providing a valuation framework in which the farmer can both track the progress of and changes to the physical natural capital flows on farm, analyse the extent to which these flows may be realised in-hand by the business, and access projections for how the underlying assets will be valued over time.